Unlock the Benefits of Using a Home Loan Calculator for Your Next Home Purchase

Smart Funding Calculator Option: Enhancing Your Economic Computations

Envision a device that not only simplifies complex lending computations but also provides real-time understandings right into your monetary commitments. The wise finance calculator remedy is made to streamline your financial calculations, offering a seamless method to examine and prepare your loans.

Benefits of Smart Loan Calculator

When analyzing monetary alternatives, the advantages of using a smart lending calculator come to be obvious in helping with notified decision-making. By inputting variables such as lending quantity, passion rate, and term size, people can assess different circumstances to pick the most economical alternative tailored to their economic scenario.

Moreover, wise financing calculators provide openness by damaging down the total expense of loaning, consisting of passion payments and any extra charges. This transparency encourages customers to comprehend the economic implications of getting a lending, enabling them to make audio economic choices. In addition, these devices can conserve time by offering immediate computations, eliminating the need for manual calculations or complex spreadsheets.

Attributes of the Device

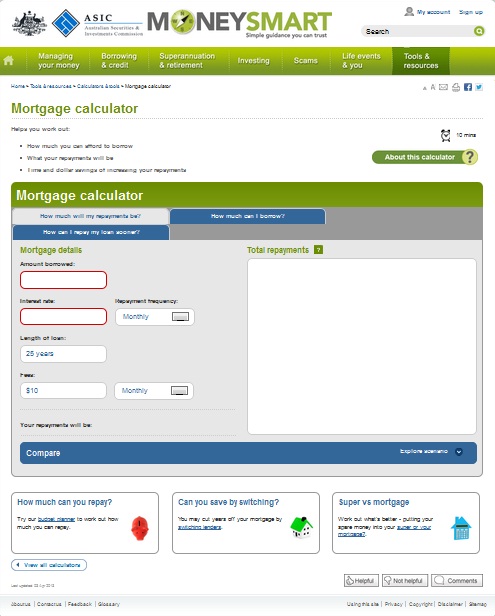

The tool incorporates an user-friendly user interface created to streamline the procedure of analyzing and inputting lending data efficiently. Individuals can easily input variables such as lending amount, passion rate, and lending term, enabling fast estimations of monthly settlements and overall interest over the loan term. The device additionally uses the versatility to change these variables to see how changes influence the total financing terms, encouraging customers to make informed financial decisions.

Additionally, the wise financing calculator provides a break down of each month-to-month settlement, showing the portion that goes towards the principal amount and the passion. This function assists users imagine exactly how their payments contribute to settling the lending with time. Users can generate in-depth amortization routines, which detail the settlement schedule and passion paid each month, aiding in lasting financial planning.

How to Make Use Of the Calculator

In browsing the financing calculator successfully, users can easily utilize the straightforward interface to input key variables and produce useful monetary insights. Individuals can additionally specify the settlement regularity, whether it's monthly, quarterly, or each year, to straighten with their monetary planning. By following these straightforward steps, users can effectively utilize the loan calculator to make enlightened monetary choices.

Advantages of Automated Estimations

Automated computations enhance financial processes by quickly and accurately calculating intricate figures. Hands-on estimations are susceptible to blunders, which can have substantial implications for financial choices.

Moreover, automated calculations conserve time and increase efficiency. Facility financial computations that would generally take a substantial quantity of time to complete by hand can be done in click to read more a portion of the moment with automated tools. This enables monetary experts to concentrate on examining the outcomes and making educated choices as opposed to investing hours on computation.

This uniformity is crucial for contrasting various economic situations and making sound monetary options based on exact data. home loan calculator. In general, the benefits of automated estimations in simplifying economic processes are obvious, offering raised precision, efficiency, and uniformity in complex financial calculations.

Enhancing Financial Planning

Enhancing monetary planning includes leveraging advanced devices and techniques to maximize financial decision-making procedures. By using sophisticated financial preparation software application and calculators, individuals and businesses can acquire deeper insights right into their economic health, set sensible objectives, and establish actionable strategies to attain them. These tools can evaluate numerous financial situations, task future outcomes, and supply referrals for effective riches monitoring and danger reduction.

Moreover, improving monetary preparation includes incorporating automation and fabricated knowledge into the procedure. Automation can enhance routine economic tasks, such as budgeting, expenditure tracking, and investment monitoring, releasing original site up time for strategic decision-making and analysis. AI-powered devices can provide tailored monetary suggestions, determine patterns, and recommend optimum financial investment possibilities based on individual risk accounts and financial goals.

In addition, cooperation with economic advisors and professionals can enhance economic preparation by using beneficial insights, industry expertise, and personalized methods customized to details economic objectives and circumstances. By incorporating innovative devices, automation, AI, and professional recommendations, individuals and companies can boost their economic planning capabilities and make notified choices to safeguard their monetary future.

Final Thought

To conclude, the smart finance calculator remedy uses many advantages and attributes for simplifying economic estimations - home loan calculator. By utilizing this tool, customers can conveniently determine funding payments, rate of interest, and settlement timetables with precision and performance. The automated calculations provided by the calculator enhance financial preparation and decision-making processes, ultimately bring about far better economic administration and educated options

The clever finance calculator service is developed to improve your monetary calculations, supplying a seamless method to evaluate and prepare your financings. Generally, the advantages of automated estimations in simplifying monetary processes are obvious, supplying boosted accuracy, efficiency, and consistency in complicated financial calculations.

By utilizing advanced economic planning software program and businesses, people and calculators can acquire much deeper insights into their financial wellness, set practical goals, and create actionable plans to achieve them. AI-powered tools can provide individualized economic advice, recognize fads, and recommend optimum investment chances based on specific threat accounts and financial objectives.